When everybody is outsourcing and U.S. banks is failing every week, why does anyone want to invest in U.S., especially as a foreigner?

The answer is always MONEY.

If one can make an above opportunity cost return, it is always a good idea for one to put his money on the table. The key is to study the possibilities thoroughly, plan the move carefully, and implement the projects forcefully. This BLOG dedicates to investigate the opportunities, risks, and costs of foreign direct investment (FDI) in U.S.

The most compelling reason to invest in U.S. is MARKET. U.S. market is one of the most large and important markets in the world. Almost every recognized international brand in every industry wants a strong presence in U.S. market, such as Sony, Toyota, Siemens, BMW, and UBS etc. The list can go on and on. Entering U.S. market is one of the necessary steps for an ambitious business organization. Even under current severe recession and with American consumers tightening their belts, U.S. market is still one of the most vital places for global vendors.

Of course, the huge size of U.S. market itself is not the sufficient reason for foreigners to invest in U.S. During the past three decades, world exporters tried very hard to penetrate U.S. market and largely succeed in general. Just look at the annual U.S. total imports. However, for many suppliers, simply producing goods in their own factories and shipping the goods through oceans to U.S. are no longer good enough, or safe enough. The reason is PROTECTIONISM.

U.S., though always promoting free trade around the world, has a history of protectionism. One example is “Smoot-Hartley Act” during the Great Depression. A more recent example is the import tariff toward Japanese automobiles in 1980s. Does anyone forget “the Plaza Accord” on September 22, 1985? This is not to criticize the U.S.’s protectionism policy or its hypocrite attitude toward free trade, but rather simply state the obvious fact. When time is bad, protectionism is always the first and the most popular weapon that the government can deploy. Anyone who is not total ignorant can bet that the world is entering a stage of protectionism.

Facing the harsh reality, what should our producers do? Of course I think that one should always focus on its domestic market first. Support your own people. But would you rather let your rivalry take advantage the recession to grab more market shares and grow their businesses in the largest market in the world, while you are rejected by the trade barrier? Protect your marketplace and keep your access to market safe. This is the single biggest reason why you should consider invest your money in U.S.

Another reason of investing in U.S. is technology. U.S., while is gradually losing its edge in several technologic fronts, is still enjoying huge leads in many fields, such as energy efficiency, electronic engineering, bioengineering, heavy mechanics, aviation and aerospace technology. To shorten the technologic gap, investing in U.S., especially merger and acquisition, is essential to obtain the important intellectual patents and engineering know-how.

Also, U.S. has a largest pool of talents in the world. It is relatively easier to find qualified engineers, scientists, marketing experts, and managers. Usually it is quite expensive to hire American skilled employees. But under the current recessionary circumstance, you will be in a strong position to take advantage of this employer’s market. It would be a good strategy if you can hire some essential employees and transfer their know-how and experiences into the institutional knowledge of your organization.

There are many other reasons of investing in U.S. that are cited by those consulting companies, such as capital availability (usually true, but not so distinguished from many other regions in the world nowadays), political stability (NOT automatically translated to low political risks, especially for foreigners), transparent and fair legal system (but complicated and expensive, could be a huge disadvantage to foreigners), integrated internal market (mostly true, but depending on industry), and ample natural resources (true but not so cheap). This post won’t analyze everyone of them. There are also numerous downsides of investing in U.S., largely due to the cultural gaps and the higher costs to manufacture goods and provide services in the states.

Again, make carefully calculation before you move, the winners of this recession will not only survive but also dominate in the future.

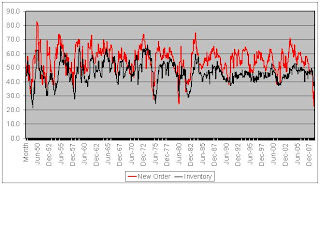

The“change in private inventories” is the contributions of change in private inventories to the annualized percent change in real GDP of U.S. PMI is the purchase manager index. The graph is from the beginning of PMI publication in 1948 to March 2009. The pattern from the chart is clear and intuitive. Whenever PMI dropped below 50, it means that the level of manufacturing activities drops compared to the previous month, manufacturers reduce production, and let the inventory adjust. When inventory runs down to a level that it no longer satisfies the final demand, the production can resume again. This is just economics 101. Plain and simple.

The“change in private inventories” is the contributions of change in private inventories to the annualized percent change in real GDP of U.S. PMI is the purchase manager index. The graph is from the beginning of PMI publication in 1948 to March 2009. The pattern from the chart is clear and intuitive. Whenever PMI dropped below 50, it means that the level of manufacturing activities drops compared to the previous month, manufacturers reduce production, and let the inventory adjust. When inventory runs down to a level that it no longer satisfies the final demand, the production can resume again. This is just economics 101. Plain and simple. You can see that new order series is always one step ahead of inventory series. New orders series recently just recovered from the below 30 level back to 41.2 in March. This means the number of new orders are still declining, but at a smaller pace. Notice that inventories index is now 32.2. Historically speaking, when new orders index has been lower than 30, the inventory index will also go down to the level of 30. It seems that the inventory is near the bottom now.

You can see that new order series is always one step ahead of inventory series. New orders series recently just recovered from the below 30 level back to 41.2 in March. This means the number of new orders are still declining, but at a smaller pace. Notice that inventories index is now 32.2. Historically speaking, when new orders index has been lower than 30, the inventory index will also go down to the level of 30. It seems that the inventory is near the bottom now.